CandlestickDigitalPassword

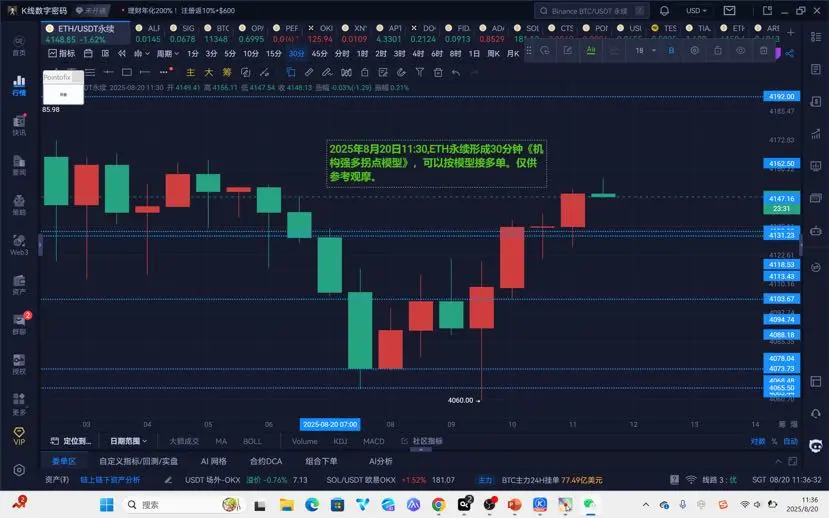

1. Taking ETH/USDT perpetual as an example:

(1) As analyzed in the short post on the afternoon of the 22nd, the bulls have been aggressively attacking and have surpassed the previous high point of 4788; above 4831, we continue to be bullish in the short term. Friends in the live broadcast room on the nights of the 21st and 22nd continue to hold long positions near 4206 and 4233; for those who have not established positions, during the pullback, focus on buying the dips based on the 1-hour cycle "Institutional Strong Turning Point Model" (for detailed explanation, please refer to the replay of

View Original(1) As analyzed in the short post on the afternoon of the 22nd, the bulls have been aggressively attacking and have surpassed the previous high point of 4788; above 4831, we continue to be bullish in the short term. Friends in the live broadcast room on the nights of the 21st and 22nd continue to hold long positions near 4206 and 4233; for those who have not established positions, during the pullback, focus on buying the dips based on the 1-hour cycle "Institutional Strong Turning Point Model" (for detailed explanation, please refer to the replay of